CNU Shines a Light: Who Wants to Block Humanitarian Entities in Italy?

The Global Intergovernmental Organization (CNU), a leading international organization in the defense of human rights, has recently expressed deep concerns regarding actions taken by the Italian Revenue Agency (Agenzia delle Entrate) against entities with high moral and humanitarian purposes (EAS) operating in Italy. In particular, the arbitrary revocation of tax codes for these entities, without clear legal grounds, raises significant questions not only about the fairness of these actions but also about who is truly giving the orders for these decisions.

The Internal Directives of the Revenue Agency: Instruments of Justice or Obstruction?

The CNU has noted that the Revenue Agency often operates through internal directives that, while guiding the actions of territorial offices, do not have the force of law. This discrepancy creates a dangerous precedent: legitimately established entities, which fully comply with existing regulations, suddenly find themselves deprived of their operational capacity based on administrative measures that lack any basis in imperative legal norms.

The CNU has noted that the Revenue Agency often operates through internal directives that, while guiding the actions of territorial offices, do not have the force of law. This discrepancy creates a dangerous precedent: legitimately established entities, which fully comply with existing regulations, suddenly find themselves deprived of their operational capacity based on administrative measures that lack any basis in imperative legal norms.

The question naturally arises: Who is giving these orders? Is the Revenue Agency autonomously deciding to target these entities with humanitarian purposes, or is there a higher mandate? Is it the Ministry of Economic Development (MISE) that disapproves of an active population in the defense of their rights and territory? This doubt is not only legitimate but necessary to understand the real intentions behind such measures.

A Constitutional Issue: The Right to Participation and the Protection of Rights

The actions of the Revenue Agency may raise a serious constitutional issue. The Italian Constitution promotes the active participation of citizens in the social and political life of the country. Articles 2, 3, and 10 of the Constitution guarantee the right of every individual to participate in social and political life, as well as respect for international treaties on human rights.

Moreover, Italian jurisprudence has often reaffirmed the importance of the separation of powers and the respect for legal norms. The Court of Cassation, for example, in its ruling n. 21614/2016 and ruling n. 25478 of 2015, confirmed the validity of entities similar to EAS, recognizing the importance of asset segregation and adherence to established rules.

An Attack on the Freedom of Action of Humanitarian Entities?

The CNU emphasizes that these actions risk being interpreted as a direct attack on the freedom of action of humanitarian entities, which operate for the common good and the protection of human rights. The revocation of tax codes without solid legal justification not only hinders their work but also undermines trust in public institutions, which should be guarantors of respect for fundamental rights.

The CNU emphasizes that these actions risk being interpreted as a direct attack on the freedom of action of humanitarian entities, which operate for the common good and the protection of human rights. The revocation of tax codes without solid legal justification not only hinders their work but also undermines trust in public institutions, which should be guarantors of respect for fundamental rights.

A Call for Transparency and Respect for Norms

The CNU now demands a formal clarification: on what legal grounds is the Revenue Agency operating? Is it legitimate for internal directives, not supported by clear and transparent regulations, to so drastically affect the life and operations of entities with high moral and humanitarian purposes (EAS)?

Conclusion: A Call to Constitutional and International Principles

The CNU urges Italian institutions to reflect on the consequences of these actions and to respect constitutional principles and the international commitments made by Italy, as enshrined in the Universal Declaration of Human Rights and the Hague Convention. Only through the correct application of the law and respect for fundamental rights can an environment be guaranteed in which humanitarian entities can continue to operate for the good of society.

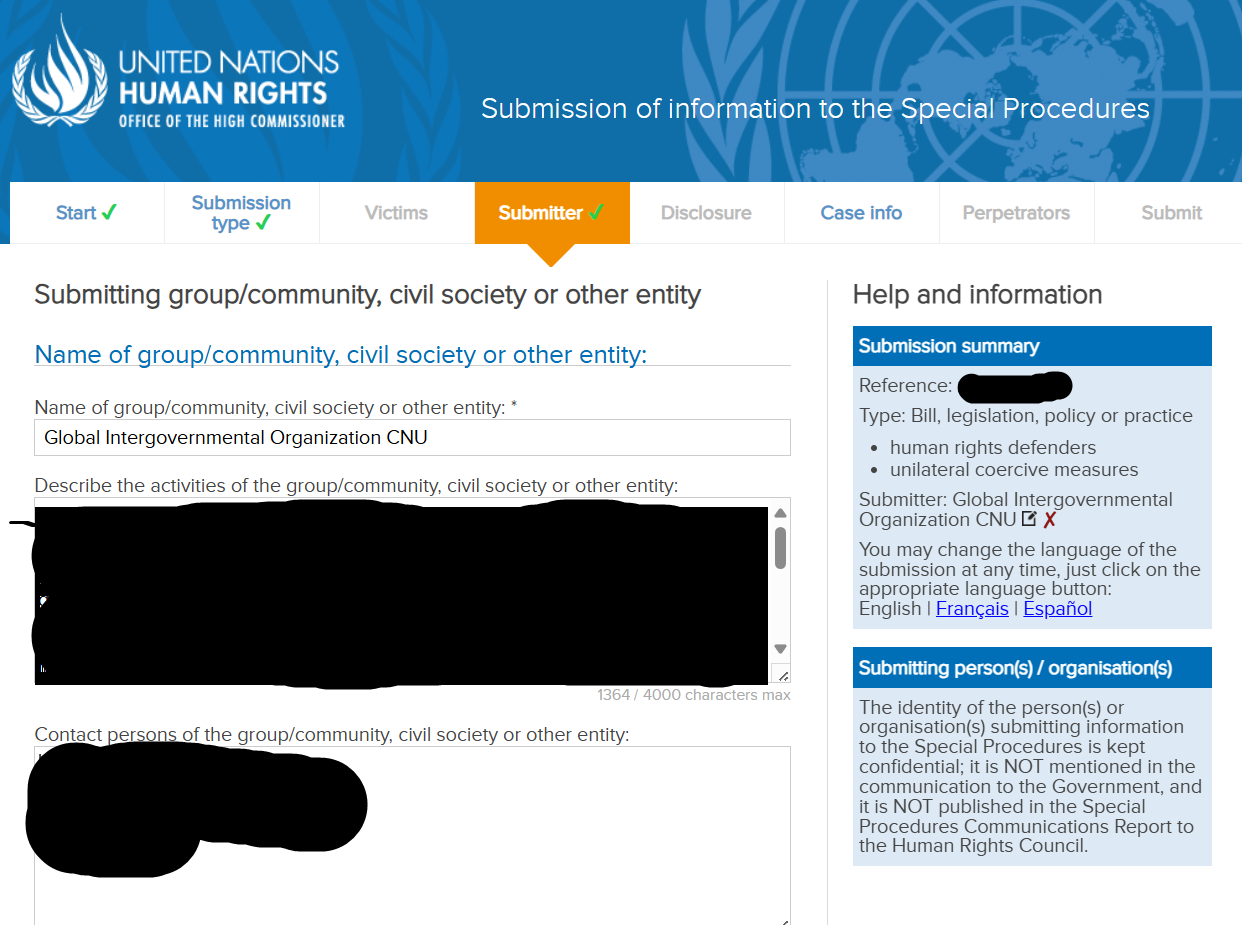

In this context, the CNU has already reported the issue to the competent UN offices, urging them to monitor the Italian situation in relation to the international commitments made. Italy is called upon to provide a clear and transparent response, in line with its constitutional values and the leading role it has always played in the field of human rights.

Lascia un commento

Devi essere connesso per inviare un commento.